Austin American-Statesman: Monthly child tax credit payments start hitting bank accounts today. Here's what to know

By sunset, millions of parents across the country will find more money in their bank accounts and mailboxes than they started the day with.

The IRS sent out its first batch of expanded monthly child tax credit payments Thursday. The agency said roughly $15 billion reached about 35 million families, with 86% of payments sent by direct deposit.

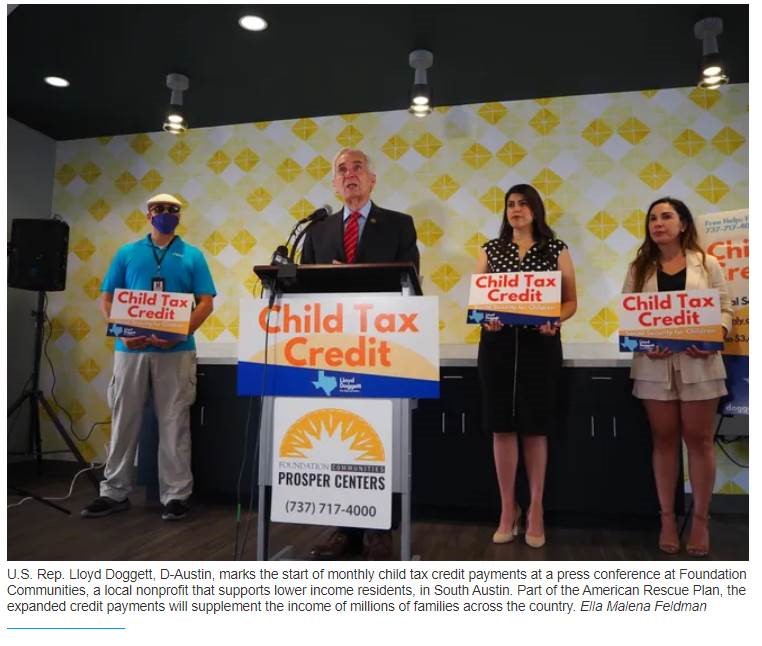

In a world still grappling with the ongoing ramifications of a devastating pandemic, the expansion of the child tax credit is cause for celebration, said U.S. Rep. Lloyd Doggett, D-Austin, who voted to pass the monthly payments into law.

"So much bad news around the world and across the nation," Doggett said at a press conference Thursday in South Austin. "But this is really good news. Because when people look at their bank account tonight, if they have a child, they're going to see more money in their bank account. And we're celebrating that."

Cristina Guajardo, a recent graduate of Texas State University and a mother, said the child tax credit has been invaluable to her family. At the start of the pandemic, Guajardo lost her job, and the childcare center her son was in closed. With this year's monthly payments, Guajardo said she'll be able to comfortably afford daycare and focus on her job search.

"The child tax credit will provide me some peace of mind in this season of so much transition — from student to full-time employee, from a pandemic to, hopefully, a post-pandemic recovery," Guajardo said. "I believe this tax credit helps to make sure that as the world opens up again, we are truly all able to move forward together."

So, how exactly do the child tax credit payments work? Who qualifies? And how long will they last? Here's everything you need to know:

What exactly are these monthly payments?

The monthly payments that kicked off Thursday are part of the American Rescue Plan, which expanded the income tax credit program for families with children for 2021. Payments are up to $300 a month for each child younger than 6 years old and up to $250 a month for each child ages 6 to 17. There is no cap on the number of children per family that can be included in the payments.

What did the program expansion change?

A few things: First, the dollar amount available per child increased. Families now are eligible to receive a maximum yearly credit of $3,600 for each child under 6 and $3,000 for children ages 6 to 17, which is an increase from the previous rate of $2,000 per child. Eligibility also expanded — all families are now eligible for the credit, no minimum income necessary. And payments are now being delivered monthly, as opposed to the previous yearly lump sum.

Who is eligible?

To qualify for the advance child tax credit, parents must:

Have at least one child under 18 years old;

Make less than $75,000 a year if filing alone, less than $150,000 if filing jointly, or less than $112,500 for unmarried single parents;

Reside in the United States for at least six months; and

Live with the child being claimed as a dependent for at least half the year.

To be eligible, your child must not turn 18 before Jan. 1, 2022. Parents with college students and dependents 18 and older are not eligible to receive the advance child tax credit. If you had a child any time in 2021, you are eligible.

If you make more than the threshold income requirement, it doesn't mean you aren't eligible for the child tax credit. The credit just gets reduced. The tax credit is reduced by $50 for every $1,000 your income exceeds the requirement, until the credit amount reaches $2,000.

How do I get my payments?

If you're eligible for the advance child tax credit and filed your taxes in 2020, you don't need to apply or sign up. But don't sweat it if you didn't file — the IRS has a tool to ensure that families who didn't file a 2020 tax return can still get their child tax credit. The Child Tax Credit Non-filer Sign-up Tool is available on the agency's website.

Foundations Communities, a local nonprofit that supports lower income residents, has a program dedicated to helping community members navigate taxes. A page on their website is dedicated to answering questions about the child tax credit and offers free support services for anyone who can't access their payments.

How long will payments last?

Payments will be delivered through the end of 2021. Besides the July 15 payment, payment dates are: Aug. 13, Sept. 15, Oct. 15, Nov. 15 and Dec. 15.

You can find more information on the child tax credit at irs.gov